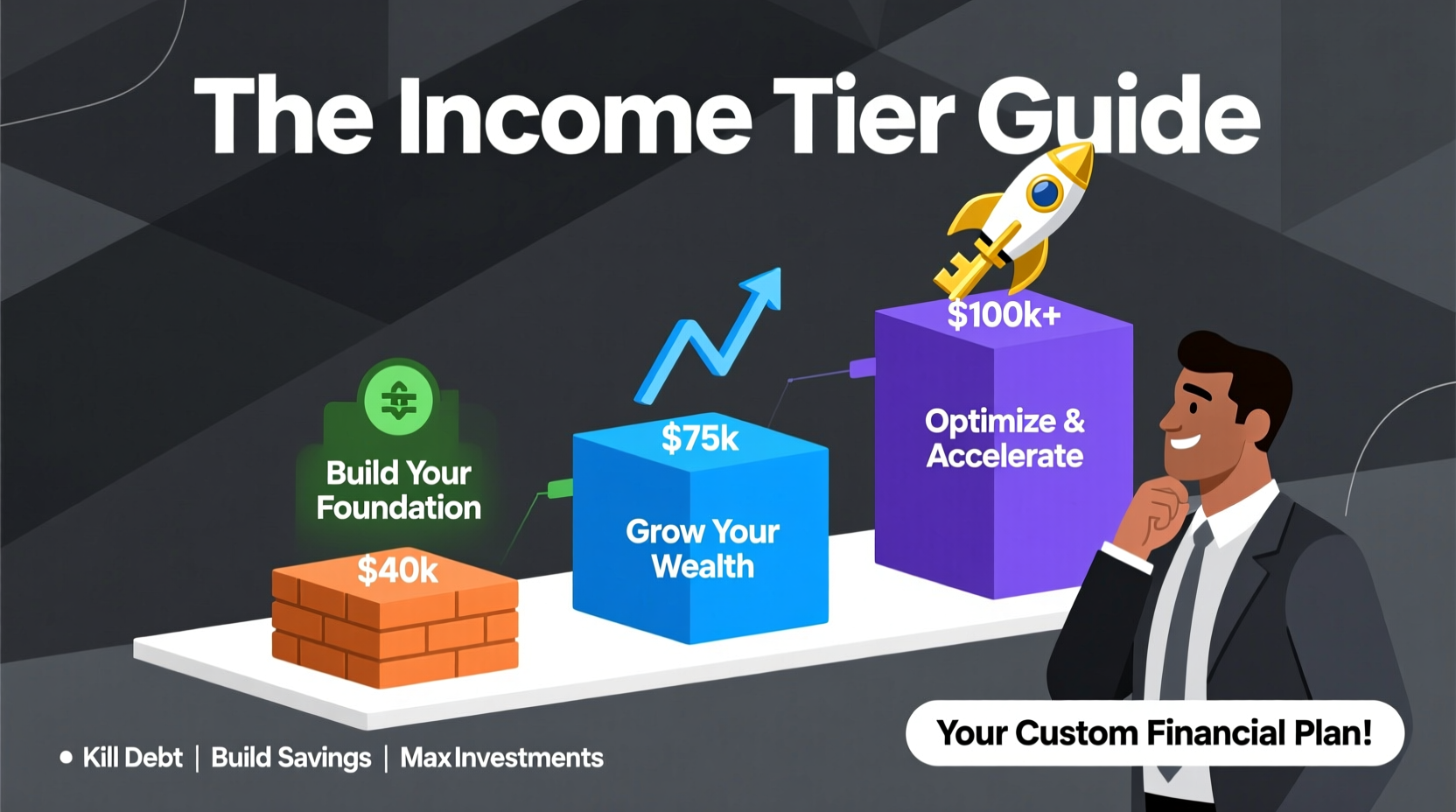

Your Financial Game Plan: Tailored Strategies for a $40k, $75k, or $100k+ Salary

Navigating your finances can feel overwhelming. There’s no one-size-fits-all solution, and the advice that works for a recent graduate often doesn’t apply to a seasoned professional. The truth is, your financial strategy should evolve as your income grows.

Today, we’re breaking down actionable financial milestones and strategies into three distinct income brackets: $40,000, $75,000, and $100,000 and above. Whether you’re just starting out, hitting your stride, or building significant wealth, having a clear, phase-appropriate plan is the key to long-term success.

Let’s dive into the financial game plan for your income level.

The $40,000 Salary: Building Your Financial Foundation

When I first graduated college, my starting salary was $38,000 working a customer service job. I remember this time being challenging, but it was also a period where I learned the immense value of every single dollar. If you’re at this level, it’s important to acknowledge that you can make it work. In fact, managing a lower income skillfully demands immense respect, as your financial decisions here carry the most weight. Every dollar has a job to do, and your focus must be on creating stability.

At this stage, if you can save even 10% of your gross income towards your goals, you’re building powerful habits for the future. I recommend focusing on three core objectives.

Goal 1: Eliminate High-Interest Consumer Debt

Carrying consumer debt—especially from credit cards or “buy now, pay later” services—is a burden at any income level. But at $40,000, it can be catastrophic. The average take-home pay for this salary is roughly $2,700 per month. That $2,700 must cover rent, groceries, transportation, and hopefully, some savings.

The average credit card balance in America hovers around $5,700. If you’re paying interest on that, even a $100 monthly interest charge could be the difference between making rent or not, or between saving for retirement and falling further behind. Your first major victory at this income level is to become debt-free. Direct that 7-10% of your income you’re aiming to save straight toward eliminating this debt. Consider it your most urgent investment.

Goal 2: Establish Your Financial Safety Net

Once you’ve tackled high-interest debt, it’s time to build your financial foundation. This has two key components: an emergency fund and your first foray into investing.

If you have no safety net, take that 7-10% savings rate and build a starter emergency fund. The goal is to have at least three months of essential expenses saved. If your monthly necessities cost $2,000, target a $6,000 emergency fund. This cash buffer is what prevents a flat tire or a medical bill from forcing you back into debt.

After your emergency fund is secure, you can begin investing. The best vehicle for most people at this stage is a Roth IRA. Since you contribute with after-tax money, your earnings grow completely tax-free, and you can withdraw them in retirement without paying a cent to the IRS. The current annual contribution limit is $7,000 for those under 50. Even contributing a small, consistent amount each month can harness the power of compound interest over decades.

Goal 3: Explore avenues for Income Growth

This goal is about looking forward. You don’t necessarily need to switch careers overnight, but exploring ways to increase your earning potential is a critical investment in yourself.

A $40,000 annual salary breaks down to about $20 per hour. If you can find a side hustle or freelance work that pays $25 or $30 per hour, you’re dramatically increasing the value of your time. Think about the knowledge you already possess. Have you been playing guitar since you were a kid? Perhaps you can give lessons. Are you a whiz with graphic design software? Maybe you can take on small projects.

If a side hustle isn’t appealing, consider investing in a credential within your current field. For instance, in the logistics industry, becoming a Certified Automotive Fleet Manager can reportedly boost a median salary of $55,000 to over $70,000. Look around your industry; often, a single certification can open doors to a higher pay grade.

A Note on Budgeting: Saving 10% on a $40,000 salary is challenging. This is where meticulous budgeting becomes non-negotiable. One of the biggest budget leaks for many people is forgotten subscriptions. It’s shockingly easy to lose track of $10 or $15 monthly charges for services you no longer use. These small amounts add up to hundreds of dollars per year. Using a budgeting app can help you identify and cancel these unnecessary expenses, freeing up crucial cash for your debt, emergency fund, and investment goals.

The $75,000 Salary: Shifting from Survival to Strategy

Reaching a $75,000 income, which is close to the median household income in America, is a significant milestone. Your take-home pay jumps to approximately $4,650 per month. This extra breathing room is your opportunity to shift from a short-term survival mindset to a long-term wealth-building strategy.

The fundamentals from the previous stage still apply—ensure any lingering high-interest debt is cleared—but your focus now expands.

Strategy 1: Master Your Cash Flow with Precision Budgeting

With more income comes more complexity, especially if you have a family. Now is the time to master your cash flow. This means moving beyond simple tracking and into intentional spending.

Go through your bank and credit card statements from the last three months. Categorize every single expense. You might be shocked to find you’re spending $800 a month on “miscellaneous” shopping. Once you see the data, you can cut relentlessly. A powerful tactic for curbing impulse spending is the 24-hour rule. When you want to make a non-essential purchase, force yourself to wait a day. Often, the urge passes.

Another effective method is using cash envelopes for variable spending categories. If you budget $200 for “entertainment,” take that amount out in cash at the start of the month. Physically seeing the money leave the envelope creates a psychological connection to spending that a simple card swipe does not.

Strategy 2: Become Obsessed with Your Net Worth

At this stage, your salary is important, but your net worth—your assets minus your liabilities—is the true measure of your financial health. Tracking this number is like stepping on the scale when you’re dieting; it provides undeniable feedback.

Consider the data. The median net worth for someone in their 30s is around $35,000. However, Fidelity recommends that by age 30, you should have at least your annual salary saved for retirement. For someone earning $75,000, that’s $75,000—more than double the median net worth.

This discrepancy highlights a crucial point: to retire comfortably, you must aim well above the average. A good goal is to target double the median net worth for your age and align your savings with Fidelity’s guidelines (1x salary by 30, 3x by 40, etc.). This turns an abstract concept like “building wealth” into a concrete, measurable target.

Strategy 3: Target a Retirement-Driving Savings Rate

Your net worth doesn’t grow by accident; it’s a direct result of your savings rate. The earlier you start, the less you have to save each month, thanks to compound interest. However, if you’re getting a later start, you need to be more aggressive.

Let’s look at a $75,000 earner aiming for $750,000 by age 67 (roughly 10x their salary):

- If they start at age 30 with $0 saved, they need to save and invest about 4.6% of their income annually.

- If they wait until age 40, that required rate jumps to over 10.5%.

- If they delay until age 50, they would need to save a daunting 27% of their income.

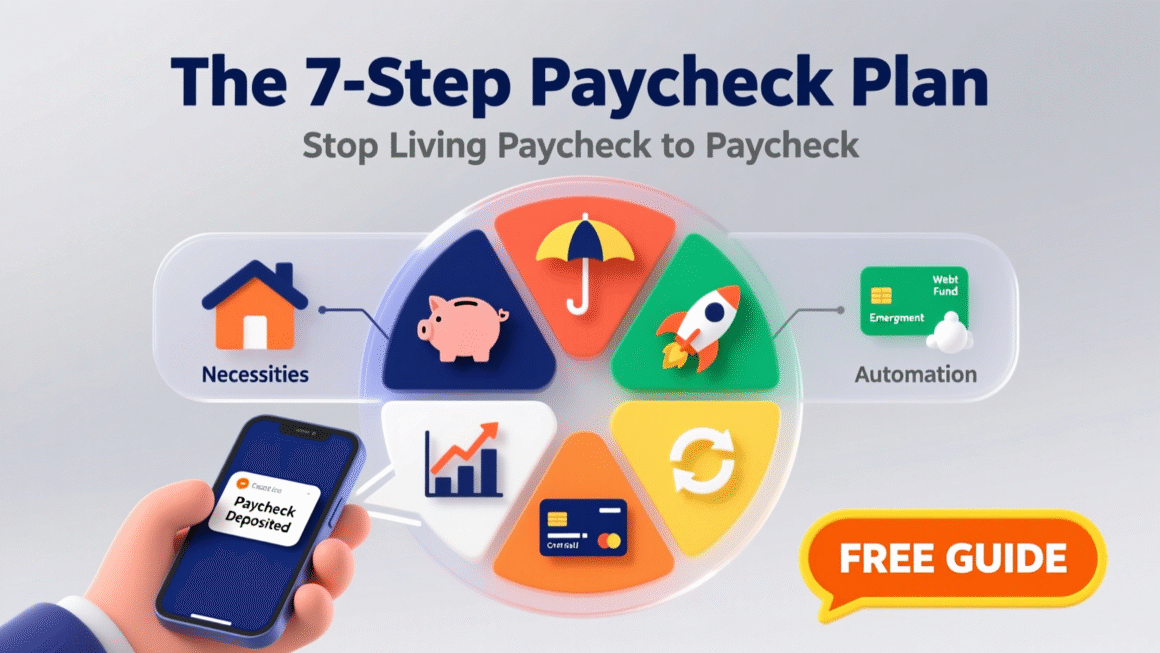

This math is unforgiving but clear. Consistency is everything. Aiming to save 15-20% of your gross income, often through automated contributions to your 401(k) and maxing out your Roth IRA, will put you on autopilot for a secure future.

The $100,000+ Salary: Optimizing Wealth and Guarding Against Complacency

Reaching a six-figure income is a tremendous achievement. In most cities, you are comfortable, your bills are covered, and the constant stress of living paycheck-to-paycheck should be in your rearview mirror. The game at this level changes from building wealth to accelerating it, while defending against your biggest enemy: yourself.

Priority 1: Wage War on Lifestyle Creep

Lifestyle inflation is the silent dream killer for high earners. It’s the natural tendency to increase your spending every time you get a raise. While it’s perfectly reasonable to improve your quality of life, unchecked spending can trap you in a “golden cage” where you earn a lot but save very little.

The goal is to live beneath your means, not at the edge of them. This isn’t about deprivation; it’s about conscious spending. If you want a new car, that’s fine. A good guideline is the 20/4/10 rule: put 20% down, finance for no more than 4 years, and ensure the monthly payment is less than 10% of your gross monthly income. The problem isn’t upgrading your car; it’s financing a luxury vehicle that consumes 20% of your income, forcing you to sacrifice your savings goals.

Priority 2: Calculate Your Path to Financial Independence

With a high income, early retirement—or at least achieving financial independence—becomes a tangible possibility. This is the point where your investment portfolio can generate enough passive income to cover your living expenses, giving you the freedom to work by choice, not necessity.

The key variable here is your savings rate. If you have a portfolio of $250,000, make $100,000 per year, and save 20% of it, you could potentially retire in under 20 years. Bump that savings rate to 30%, and your timeline shrinks to around 16 years. This is the core philosophy of the FIRE (Financial Independence, Retire Early) movement. By being extremely intentional with your spending, you can accelerate your journey to freedom dramatically.

Priority 3: Strategically Pursue Asymmetric Returns

This is a more advanced strategy and not for everyone. The classic “invest in low-cost index funds” advice is still the bedrock of a solid portfolio. However, when you have a high income and a solid base of investments, you may consider allocating a small, risk-designated portion of your portfolio to higher-conviction plays.

The key is to decide what percentage you are willing to risk—perhaps 5% or 10% of your total portfolio—and only use that capital. This could be for investing in individual stocks you’ve deeply researched, real estate syndications, or other alternative assets. Some of the most significant gains in my own portfolio have come from concentrated positions in companies or assets I believed in strongly, like Nvidia or Bitcoin.

A major disclaimer: This requires extensive research, a high risk tolerance, and the emotional fortitude to potentially lose this entire allocation. Your “edge” should come from investing in areas you understand deeply, not from speculation. For 95% of people, a simple index fund strategy is the wisest path. But for those with the capital and the knowledge, this can be a way to accelerate growth.

The Journey is Yours

Your financial journey is a marathon, not a sprint. The strategies that serve you at $40,000 will lay the groundwork for your success at $75,000, which in turn will empower the decisions you make at $100,000 and beyond. The common thread is intentionality: living on less than you make, investing the difference consistently, and always keeping your long-term vision in clear sight.

No matter where you are today, you have the power to take the next step. Define your goals, implement the strategy for your current bracket, and build the financial future you deserve.