We’ve all tried it at some point—that sinking feeling on a Sunday night, a fresh notebook open, a pen poised with optimistic determination. We’re going to “set a budget.” We jot down our rent, our car payment, and with a grimace, we write “groceries.” We feel virtuous, responsible. We’ve got a plan.

But let’s be honest, shall we? Most of these budgets don’t just falter; they spectacularly implode within a few weeks, sometimes even days. They either feel like a financial straitjacket, leaving you gasping for the simple joy of an unplanned coffee, or they prove to be completely impossible to follow, built on a foundation of wishful thinking rather than the messy reality of life. And let’s not forget the third, and perhaps most deadly, budget-killer: they’re just plain boring. Tracking every single penny can feel like a soul-crushing chore, a constant reminder of what you can’t have.

So, we give up. We toss the notebook in a drawer, vowing to try again “next month.” The money continues to flow in, and then, mysteriously, it flows right back out again, leaving behind a vague sense of anxiety and that perennial question: “Where did it all go?” What if there was a different way? Not a budget of deprivation, but a budget of intention. What if there was a budgeting method that actually worked with your brain, not against it—one you could stick to, that didn’t make you feel like you were sentenced to a life of lettuce leaves and instant noodles?

There is. And it’s time you met it.

Meet Your New Financial GPS: Zero-Based Budgeting

Enter the “Zero-Based Budgeting” method, a system that gracefully flips traditional, flimsy budgeting on its head. While most budgets are reactive—you spend, you feel guilty, you try to track the damage—this method is gloriously proactive. Instead of just passively tracking what you’ve already spent, this method assigns every single dollar a job before the month even begins. Your income hasn’t even hit your bank account yet, and it already has a mission.

Think of your money not as a vague, slippery pool of cash, but as a team of dedicated employees. Each one has a specific role to play, a task to accomplish. This dollar is your Rent Manager. That one is your Grocery Specialist. These five over here are your Debt Destruction Team. And that little guy in the corner? He’s your “Dream Vacation Fund” intern, working his way up. By the time your paycheck lands, every single dollar is already clocked in and working for you. Nothing is left idle, lounging around in your checking account, waiting to be accidentally wasted on an impulse buy or frittered away on things you won’t even remember.

Here’s the real magic of it: this process fundamentally shifts the power dynamic. You stop being a passive bystander watching your money disappear. You become the CEO of your finances. You control your money, decisively and deliberately, instead of letting it control you. Because each dollar has a pre-assigned purpose, you know exactly where it’s going. That means fewer of those wincing “oops” moments at the grocery store checkout, less money silently slipping through the cracks on takeout and online subscriptions, and a whole lot more confidence and clarity in every financial decision you make.

It sounds almost too simple, doesn’t it? But the power isn’t in its complexity; it’s in its thoroughness. Let’s break down exactly how to build this from the ground up.

Laying the Foundation: Your Step-by-Step Blueprint

Getting started with Zero-Based Budgeting doesn’t require a finance degree, just a little bit of time and a commitment to being brutally honest with yourself. You can use a fancy app, a spreadsheet, or my personal favourite, a simple pen and a notebook. There’s something about writing it down that makes it feel more real.

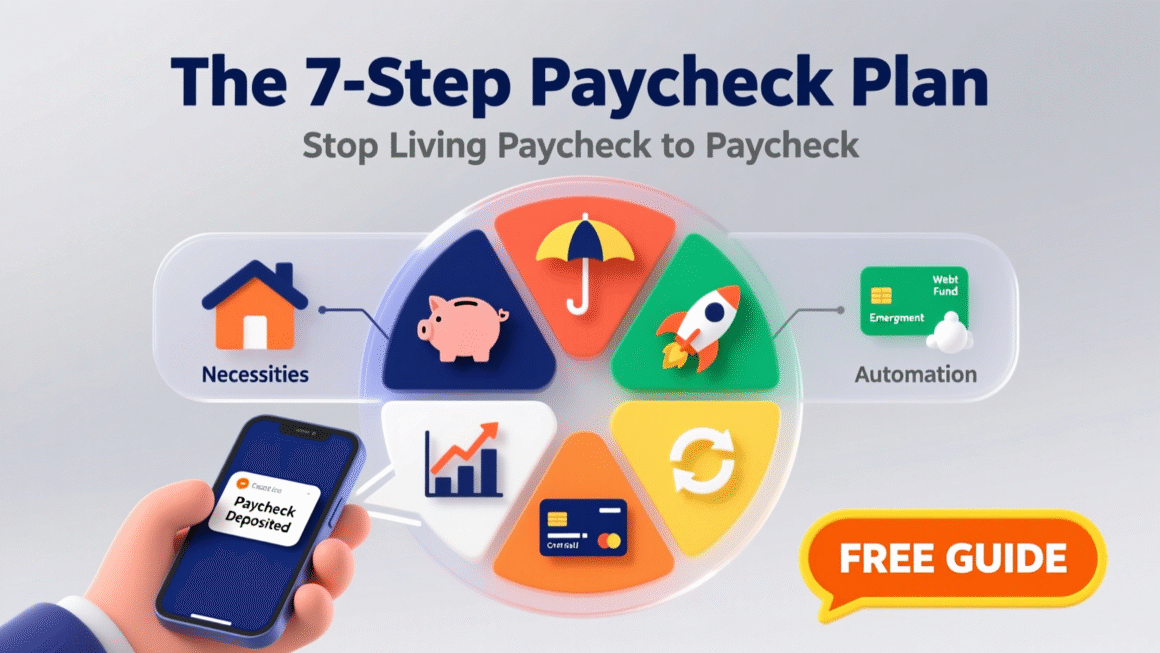

Step One: Calculate Your Monthly Income – The Whole Picture

This is your starting line, your foundation. You need to know, down to the last penny, exactly how much money you have to work with this coming month. This means your primary salary after taxes (your net income), but it also means everything else. Do you have a side hustle? Include it. Do you drive for a delivery service occasionally? Include it. Freelance gigs, a small Etsy shop, that twenty-dollar bill your aunt slipped you—if it’s money coming in, it counts. The crucial part here is to work with actual numbers, not estimates or hopeful guesses. If your income is irregular, take a conservative average from the last few months. Knowing your true financial battlefield is the first step to winning the war.

Step Two: List Every Single Expense – No Hiding Allowed

Now, we move to the other side of the equation. Grab that pen again. It’s time to list out every single thing you will need to pay for in the upcoming month. And I do mean everything. Not just the big, obvious pillars like rent or mortgage and car payments. We’re talking about the full, unvarnished truth of your spending.

Start with your fixed expenses: rent, utilities (electric, water, gas), internet, phone bill, car insurance, streaming subscriptions (Netflix, Spotify), debt payments (student loans, credit cards). These are the non-negotiables.

Then, move to your variable expenses. This is where most budgets get fuzzy, but we’re going for clarity. Groceries. Gasoline or public transport fares. Coffee shops. Dining out. The money you set aside for hobbies. Your monthly haircut. That birthday gift you need to buy for your friend. Dog food. Toiletries. Even the five dollars you might drop on a food truck lunch. The key here is completeness. If it’s a recurring expense or even just likely to happen this month, it needs a line on the budget. This is where you stare your financial habits directly in the face, without flinching.

Step Three: Assign Every Dollar a Job – The “Zero” Moment

Alright, here’s where the Zero-Based Budgeting system truly shines, where it separates itself from every other half-hearted method you’ve tried. You have your total income number. You have your list of expenses, both fixed and variable. Now, you begin the process of giving every single dollar from your income a specific job.

You start by funding your fixed expenses. Assign dollars to cover your rent, your utilities, your minimum debt payments. Then, you move to your variable expenses. You decide, right now, how much you will spend on groceries this month. You assign a specific amount for dining out, for entertainment, for clothing. You are not tracking as you go; you are planning.

Then, you go beyond mere spending. You assign dollars to your savings goals. How much will go into your emergency fund this month? What about that down payment for a car? Your retirement fund? Your vacation fund? These are not afterthoughts; they are line items, just as important as your electric bill. You are paying your future self, first.

You keep going, down your list, until you have allocated every single dollar of your income. And this is the beautiful, mathematical elegance of it: when you subtract all of your assigned jobs from your total income, the result should be zero.

Income – Assigned Jobs = $0.00

Hence, “Zero-Based.” This doesn’t mean you have zero dollars in your bank account! It means you have zero idle dollars. Every dollar has a mission. There’s no ambiguous pool of cash left over that just… vanishes. This is the core of the system. This is what ensures that nothing is left floating around to tempt you into impulsive spending. If a dollar doesn’t have a job, it will find one, and you probably won’t like the job it picks.

Step Four: Track and Adjust – The Art of Flexibility

Now, a crucial point: this is not a “set-it-and-forget-it” system. You are not carving your budget into stone tablets. You are drawing a map for the month, but sometimes, you encounter a roadblock or a beautiful, unplanned scenic route. Life happens. Maybe your electricity bill is fifty dollars higher than expected because of a heatwave. Maybe you get a flat tire. Maybe you spontaneously splurge on a concert ticket with friends.

That’s fine! Truly, it is. The key is not to pretend it didn’t happen and let your budget collapse. The key is to adjust. This is the living, breathing part of the process. If you overspend in your “Dining Out” category, you don’t just throw your hands up. You look at your other categories. Maybe you move some dollars from your “Clothing” category to cover the difference. You are essentially telling the dollars, “Change of plans, team! We need to re-deploy you.” You move the money around on paper (or on your app), and you ensure that your equation always, always balances back to zero.

This act of adjusting isn’t a failure; it’s the very practice that builds financial muscle and awareness. It forces you to make conscious trade-offs. “Is this night out worth having less for new shoes later?” It turns budgeting from a rigid punishment into a dynamic, empowering game.

Why This Method Sticks When Others Fail

So, why does this particular method have such a powerful effect on people? Why do they stick with it when every other budget has failed them? The benefits go far beyond just knowing your numbers.

Total Financial Awareness: You develop a state of hyper-awareness about your money. You know where every single penny is going, because you were the one who sent it there. There are no surprises, no mysterious leaks, and no more wondering where your money disappeared to by the 20th of the month. The fog lifts.

Intentionally Controlled Spending: By giving every dollar a purpose, you build a powerful fence against overspending. You can still enjoy your daily coffee—but it’s a coffee you have planned for and approved. It’s not a guilty secret; it’s a budgeted line item. This removes the guilt and empowers your enjoyment.

A Debt-Reduction Powerhouse: This method is famously effective for tackling debt. You can aggressively allocate extra money toward paying off high-interest credit cards or student loans without feeling like you’re starving yourself of fun. You see the plan in action, watching the “Debt” category get more funding while your other needs are still met, which is incredibly motivating.

A Supercharged Savings Engine: Saving stops being something you hope to do with whatever is “left over” (which is usually nothing). It becomes a non-negotiable bill you pay to yourself, right up there with rent. Whether it’s for an emergency fund, a vacation, or retirement, you are assigning funds intentionally and watching your safety net and your dreams grow, month by month.

A Fundamental Behavioral Shift: This is perhaps the most profound benefit. Over time, this process rewires your relationship with money. You stop seeing it as a limited resource that restricts you and start seeing it as a tool you wield to build the life you want. You naturally begin to prioritize what truly brings you value and happiness, and you effortlessly cut out the wasteful, impulsive purchases that brought you little joy anyway. You move from a mindset of scarcity to one of purposeful abundance.

But Is It For Me? Overcoming the Initial Hurdle

I can hear the objection now. “This sounds like a lot of work.” And I won’t lie to you—the first month or two can feel a bit tedious. It requires focus and honesty. It can be intimidating to stare your full financial reality in the face. Some people get hung up on the word “budget,” associating it with restriction.

But here’s the secret everyone who sticks with it discovers: it quickly becomes second nature. What feels like work at first soon becomes a simple, 20-minute monthly ritual. And the payoff is immense. Many users report that after just a few months, they feel more in control of their finances than they ever thought possible. The stress melts away. The dreaded overdraft fees become a thing of the past. There is a profound satisfaction that comes from watching your plan unfold, from hitting your savings goals, from seeing your debt shrink. The slight initial effort is completely dwarfed by the monumental peace of mind it provides.

Your Invitation to Financial Clarity

If you’ve been frustrated, discouraged, or just plain bored by traditional budgeting methods, consider this your invitation. Unlike the vague, unhelpful advice of “spend less, save more,” Zero-Based Budgeting gives you a concrete, step-by-step, actionable plan to make your money work for you. It’s not about restriction. It’s about intention. It’s about consciously and deliberately directing your money toward the things that matter most to you—whether that’s security, freedom, adventure, or simply a life with less anxiety.

In short, if you want a budgeting method that actually works, that sticks, and that changes your life, Zero-Based Budgeting isn’t just effective—it’s transformative. It’s the difference between being a passenger in your financial life and taking the driver’s seat. You no longer just react to money problems as they explode around you; you proactively manage your finances, steering them with purpose. It sets you up for both the short-term peace of mind that comes from knowing your bills are covered, and the long-term, thrilling financial success of building the future you truly desire. All you have to do is give every dollar a job.