Your Payday Playbook: A Step-by-Step Guide to Allocating Your Paycheck

Right now, more than 62% of Americans are living paycheck to paycheck. This isn’t just a statistic; for many, it’s the main financial lifestyle. If you’ve ever felt that nagging anxiety when a bill arrives or wondered where your money actually went by the end of the month, you’re not alone.

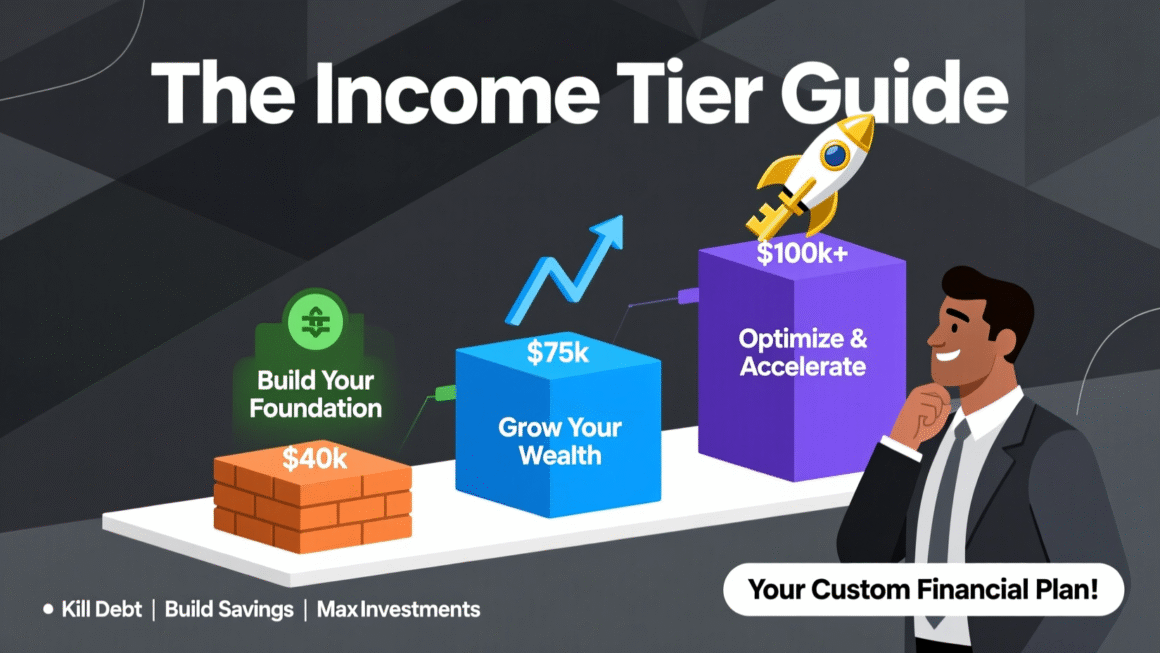

I created this guide to help you break that cycle. As a former financial adviser who has helped both close friends and countless people online get a better handle on their money, I’ve seen the transformative power of having a simple, clear plan for every dollar you earn. This is a step-by-step framework for how to allocate your paycheck, moving from covering your basics to building genuine wealth.

Let’s get started.

Step 1: The Foundation – Calculate Your True Necessities

The very first thing you need to do when your paycheck lands is to set aside money for your necessities. This category includes your rent or mortgage, groceries, healthcare, utilities, and transportation—essentially, the non-negotiable expenses you need to live your life on a monthly basis.

A common benchmark is to aim for about 50% of your take-home pay to cover these costs. Now, I’ll be the first to say this number isn’t set in stone. If you live in a high-cost-of-living area like New York City or San Francisco, your percentage might be closer to 60%. Conversely, if you live in a more affordable region, you might find it’s only 40%.

The real point of this step isn’t to hit a perfect number, but to do the math yourself and understand your own financial reality. If your necessities are consuming over 70% of your income, that’s a clear signal that you need to scrutinize your spending. Can you find a more affordable living situation? Could you reduce your grocery bill? Is there a cheaper transportation option?

Let’s look at an example. My friend Kelly lives in Los Angeles. She makes $75,000 a year at her main job in sales, which breaks down to about $4,750 per month after taxes. Her rent costs $1,800, her car payment is $400, and she spends about $500 on food. That’s already $2,700 per month, which is 56% of her take-home pay. Once we add in utilities and other miscellaneous necessary expenses, she’s easily at 60% or more.

The exercise is simple but powerful: list out all your necessities and calculate what percentage of your income they consume. Knowing this number intimately is the absolute bedrock of your financial plan, because it tells you exactly how much money you have left over for everything else that follows.

Step 2: The Safety Net – Make Minimum Payments on All Debt

Before we start aggressively tackling debt or building savings, we need to ensure we’re protecting our financial reputation. In America, and many other countries, a good credit score is crucial for securing favorable interest rates on future loans, like a mortgage.

The single most important factor in maintaining a healthy credit score is making on-time payments. It’s a game with very strict rules. Think of it this way: in school, a 90% on an exam is usually a solid A-. But in the world of credit, if you make 90% of your payments on time, your credit score will be in terrible shape.

The system is designed so that if you miss just one out of twenty payments (95% on-time), your score can take a significant hit. If you drop below 97%, it’s considered very poor. This seems harsh, but it’s the reality of the system we operate in.

So, step two is straightforward: ensure you are making the minimum payments on all your debt obligations—credit cards, student loans, personal loans—on time, every single month. This isn’t about paying off the debt yet; it’s about keeping your financial foundation stable while we prepare for the next steps.

Step 3: The Peace of Mind – Build Your Emergency Fund

Life is full of surprises, and unfortunately, many of them are expensive. Your car breaks down, you have a sudden medical bill, or you lose your job. This is where your emergency fund comes in.

Your goal is to build a buffer of three to six months’ worth of your living expenses. This money should be kept in a safe, accessible place—ideally, a high-yield savings account. The “high-yield” part is key; this means your cash is earning a decent amount of interest while it sits there, rather than languishing in a traditional checking account with near-zero returns.

Let’s go back to Kelly. Her monthly necessities total about $2,900. This means her emergency fund target should be between $8,700 (for three months) and $17,400 (for six months). This money must be liquid, meaning you can access it immediately without penalties. That’s why a high-yield savings account is perfect, as opposed to a certificate of deposit (CD), which locks up your money for a set period.

A quick note: always ensure any savings account you use is FDIC insured (or its equivalent in your country), which protects your money up to a certain amount if the bank fails.

Once you have this fund established, you can consider “buffing it up,” to use a video game term. Before I took the risk of starting my own company, I famously saved up 12 months of living expenses. That safety net gave me the confidence to pursue a big goal, knowing I could survive for a full year without a paycheck.

Step 4: The Future You – Invest for Retirement

With your essentials covered, your debt payments current, and an emergency fund in place, it’s time to start building wealth for your future self. This step is about making your money work for you over the long term.

A great goal is to set aside at least 10% of your pre-tax income for retirement. In the U.S., the primary vehicle for this is often a 401(k). The single best feature of a 401(k) is the employer match. This is when your company agrees to match your contributions up to a certain percentage of your salary.

For example, if you make $100,000 per year and your employer offers a 3% match, that means if you contribute $3,000, they will contribute an additional $3,000. That’s free money—an immediate 100% return on your investment. You should always, always contribute enough to get the full employer match.

Beyond the match, you can certainly contribute more to your 401(k), but be aware that the money is generally illiquid until you reach retirement age, with penalties for early withdrawal.

Let’s see the power of this with Kelly. If she contributes 10% of her $75,000 pre-tax salary ($7,500 per year) to her retirement account and invests it consistently over 40 years, assuming an average 8% annual return (the historical average for the S&P 500), her final balance would be nearly $2.1 million. Step four should become an automatic part of your payday routine—a cornerstone of your financial future.

Step 5: The Debt Snowball – Eliminate High-Interest Debt

Now we circle back to the debt from Step 2. If you value psychological peace of mind, you might have been eager to jump to this step sooner. However, from a purely financial perspective, securing your employer’s match and building a safety net often provides a greater return and security than paying off moderate-interest debt slightly faster.

When you are ready to aggressively pay down debt, you have two primary strategies:

- The Avalanche Method: This is the mathematically optimal approach. You list all your debts by interest rate, from highest to lowest. You make minimum payments on all of them, but you throw every extra dollar you have at the debt with the highest interest rate first. Once that’s paid off, you move to the next highest, and so on. This method saves you the most money on interest over time.

- The Snowball Method: This is the psychologically powerful approach. You list all your debts by the amount owed, from smallest to largest. You make minimum payments on all, but you focus on paying off the smallest balance first. The quick win of completely eliminating a debt provides a tremendous motivational boost, which you then carry over to the next smallest debt.

Let’s look at a hypothetical debt list:

- Credit Card 1: $5,000 owed at 18% APR

- Credit Card 2: $500 owed at 22% APR

- Car Loan: $2,000 owed at 5% APR

- Student Loan: $25,000 owed at 4% APR

- “Buy Now, Pay Later” Loan: $300 owed at 24% APR

With the Avalanche Method, you’d attack the “Buy Now, Pay Later” loan first (24%), then Credit Card 2 (22%), then Credit Card 1 (18%), then the car loan, and finally the student loan.

With the Snowball Method, you’d pay off the “Buy Now, Pay Later” loan ($300), then Credit Card 2 ($500), then the car loan ($2,000), then Credit Card 1 ($5,000), and finally the student loan.

While the Avalanche method is technically better for your wallet, I personally prefer the Snowball method for most people. Personal finance is deeply behavioral. The momentum and sense of accomplishment from the Snowball method can be the difference between giving up and seeing it through to the end.

Step 6: The Wealth Accelerator – Invest Beyond Your 401(k)

Once you’re consistently saving for retirement and making progress on your debt, it’s time to expand your investing horizons. My personal priority for investing extra money is as follows:

- Get your full 401(k) employer match. (We covered this in Step 4).

- Max out a Roth IRA.

- Go back and max out your 401(k) or invest in a taxable brokerage account.

The main advantage of a Roth IRA is that all your earnings and profits grow completely tax-free. When you retire, you can withdraw that money without owing a single penny in taxes. For 2024, you can contribute up to $7,000 per year (or $8,000 if you’re over 50). You contribute with after-tax dollars, so you’ve already paid the taxes on that money upfront.

Because of this tax-free growth, I like to adopt a slightly more aggressive strategy within my Roth IRA. I might invest in individual stocks of companies I believe will be around and thriving in 30 or 40 years—think of giants like Apple, Google, or Nvidia. The potential for higher returns is amplified by the fact that I won’t be taxed on those gains.

For a taxable brokerage account (a standard investment account), I prefer a simpler, more reliable approach using low-cost index funds. While you still have to pay taxes on any dividends or capital gains you realize, index funds are known for their simplicity and low fees.

A quick word on taxes in a brokerage account: if you sell an investment you’ve held for less than a year, you’ll pay short-term capital gains taxes, which are taxed at your ordinary income tax rate (which can be quite high). If you hold it for more than a year, you qualify for the more favorable long-term capital gains rates. This is a crucial consideration when buying and selling investments outside of tax-advantaged accounts.

Step 7: The Final Touch – Automate Your Finances

The final step to mastering your paycheck is to remove the need for willpower and constant decision-making. You want your financial plan to run on autopilot.

I used to do everything manually—transferring money to savings, moving cash to my brokerage account. It was a monthly chore. Now, with online banking, I have everything automated.

Here’s my personal system: I get paid on the 21st of each month. That money is deposited into my primary checking account, which handles all my bills and daily spending. Then, on the 22nd, an automatic transfer moves a predetermined amount into my savings account. This savings account acts as a central hub for all my “future self” money—investments, tax savings, and other goals.

You can take this even further. If you’re still building your emergency fund (Step 3), you can set up a second automatic transfer from your main savings to a specific “Emergency Fund” savings goal. The key is that once it’s set up, you don’t have to think about it. This automation frees up immense mental energy and ensures you’re consistently sticking to your plan without fail.

Your Financial Journey Starts Now

Following this payday allocation plan is a journey, not a one-time event. You might not be on Step 7 today, and that’s perfectly okay. The most important thing is to start where you are. Master Step 1, then move to Step 2, and so on.

Every financial journey is unique, but the principles of smart money management are universal. By taking control of your paycheck, you’re not just managing dollars and cents; you’re building a life of greater security, freedom, and opportunity. You have the playbook. Now, it’s time to put it into action.