How to Have Better Finances Than 95% of People in Just 3 Months

What if I told you that achieving financial stability that puts you ahead of 95% of your peers is not only possible, but it’s also surprisingly straightforward?

Let’s clear the air on a few myths right away. You don’t need a six-figure salary. You definitely don’t need to guilt-trip yourself over an occasional coffee. And you certainly don’t need to cancel every single thing that brings you joy.

Over the years, I’ve guided countless people from the exhausting cycle of living paycheck-to-paycheck to saving their first $10,000, building six-figure investment portfolios, and, most importantly, reaching a point where money is a tool, not a source of daily stress.

The secret isn’t a complex, secret strategy. It’s about mastering the fundamentals that most people ignore. It’s about clarity, automation, and a shift in mindset.

And in this article, I’m going to show you exactly how to do that.

Step One: Master the Numbers That 95% of People Ignore

Most people operate under the illusion that they have a handle on their money. But ask them one simple, direct question, and that illusion shatters: “How much do you spend in total every month?”

That’s when you get the blank stares.

This single question is the reason so many people feel stuck. If you don’t know your monthly spending, you are essentially flying a plane in a storm with no instruments. You’re making random financial decisions—a little extra spending here, an impulse buy there—and just praying it all works out. But hope is not a strategy.

The truth is, if you apply even half of what we discuss here, you will be miles ahead of everyone else. Consider this: in my experience, half the people I speak with don’t know their own annual income. A staggering 90% cannot tell you their total debt. And 95% have no idea when their debt will finally be paid off.

Worst of all, almost nobody calculates their “crossover point.” (Don’t worry, we’ll get to that later. It’s a game-changer.)

Many people will go their entire lives without knowing these basic numbers, and they will perpetually feel behind because of it. The irony is, they might actually earn a good income. They might be in a decent financial position on paper. But because they lack clarity, they feel horrible about their money.

You don’t have to feel that way. The moment you take control of your numbers is the moment you start feeling good about your money. The overwhelm dissipates. The constant wondering, “Where did it all go?” stops. You begin making moves that actually build wealth, and you get to watch it happen right before your eyes.

So, how do you go from financially lost to completely in control? It starts by asking yourself a few brutally honest questions to uncover your five key numbers.

1. What’s Your True Burn Rate?

When I ask people how much they spend each month, they often pick a number that you can instantly tell is a complete guess. First, it’s always a suspiciously round number. “Oh, about $3,000.” How convenient that it ended in a zero. Second, they answer with a feeling, not a fact: “I feel like it’s too much.”

I didn’t ask for a feeling. I asked for a number.

Then, I have them actually check their bank and credit card statements. More often than not, the real number is closer to $4,500 or even higher. Whatever number they initially thought, the reality is almost always way more. That real number is their burn rate—the total amount of money flowing out of their life every single month.

If you don’t know your burn rate, it is impossible to make any coherent financial plan. You’re just along for the ride, white-knuckling it through life, hoping you don’t drive off a cliff. We don’t want that. We want to be calm, cool, and methodical.

So, here’s how to figure out your burn rate. And no, this doesn’t require complex spreadsheets or a dozen budgeting apps. We’re going to do this right now.

- Log into your primary bank account and all your credit card accounts.

- Look at the last three full months of your spending.

- Add up the total amount spent each month. And yes, I mean total.

- “But, does that include my utility bills?” Yes.

- “What about the gas for my car, and that one time I had to fill up extra for a road trip?” I said total. What is not clear about the word T-O-T-A-L? Everything.

- Add those three monthly totals together and divide by three. That’s your average monthly spending.

I know, I know. “That didn’t include my big December vacation!” or “I had a unique medical expense that month!” We’ll account for that. For now, we just need a solid, realistic baseline to work from. That number is your burn rate. Know it. Own it. If anything, it’s probably a little low, so consider adding a 10-15% buffer to be safe.

If you don’t like what you see, don’t panic. And please, don’t shoot the messenger. I’m not the bad guy here; I’m the one helping you see the reality of your financial landscape so we can build a better map. In the next steps, I’ll show you exactly how to optimize this number.

2. How Big Is Your Money Black Hole?

Debt has a way of feeling like a vague, ominous cloud hanging over you. But the second you see the actual number in black and white, everything shifts. You stop guessing and you can start taking control.

Believe it or not, you can live a rich life even while you’re in debt. The first step is to measure the exact size of your money black hole.

Here’s what you do:

- List every single debt you owe: credit cards, student loans, car loans, mortgage, personal loans. Even that store card you opened for a 10% discount on a pair of jeans you barely wear. Write it all down.

- Next to each debt, write down the interest rate (APR) and the minimum monthly payment.

- Now, do the math. Use a simple online debt payoff calculator. If you only ever pay the minimums, how many months—or years—until you are debt-free?

Let me be blunt: if you have credit card debt at a 27% APR and you’re only paying the minimum, you could be paying it off for decades.

But here’s the magic: once you see the real numbers, you can finally take control. It’s like someone who’s been afraid to see a doctor for a decade. The fear of the unknown is worse than the reality. The doctor might give you some bad news—”You need to lower your cholesterol”—but at least you now have a prescription. You have a plan. You can sleep at night.

For example, by adding just $100 extra per month to your highest-interest credit card, you can shave years off your debt repayment timeline. A money black hole only grows when you ignore it. But once you face it, you can defeat it.

3. Are You Walking on a Financial Tightrope?

I meet a lot of people who “try” to save. When I ask, “How much are you actually saving each month?” I get a confession, not a number: “Well, I was bad last month. I know I shouldn’t have eaten out, but I just couldn’t help myself. I’ll try to be better next month.”

Let’s set aside the bizarre moral judgment we love to attach to money in this country. Let’s also ignore the questionable culinary choice. Why are you talking about trying to save? I don’t try to brush my teeth. I just do it. Saving is even easier than that because you can set it up to happen automatically.

Saving is not a vague, virtuous habit. It is your financial shock absorber. It is the difference between stability and disaster when life throws you a curveball—a layoff, a family emergency, a unexpected repair.

When people don’t have savings, they are forced into terrible decisions. They stop taking necessary medications. They take on predatory loans. Truly bad things happen. This is why you should be saving at least 5-10% of your take-home pay every month, automatically.

If you’re not saving anything right now, don’t wallow in guilt. Start today with $20. That’s less than the cost of a takeout meal. Take that amount—any amount—and prove to yourself: “I am the kind of person who saves.” You can use automated tools to make this effortless. Once saving becomes an automatic, non-negotiable part of your life, you won’t even miss the money. Then, you can gradually increase the amount.

You’ll go from walking a precarious financial tightrope to building a solid bridge with guardrails and lights. It feels safe.

4. Is Your Money Working as Hard as You Are?

Let’s be honest: I have zero interest in a life where every level gets harder, like a never-ending video game. I work hard, but I also want to enjoy my life. I want to take vacations, wear a nice sweater, and relax.

Wealthy people understand this. They don’t just earn money; they put their money to work. This is the profound power of investing.

And I’m not talking about the high-stress, stock-picking, CNBC-screaming version of investing. I’m talking about what smart investors actually do: very little. Smart investors start early, stay consistent, and let time do the heavy lifting. Investing, when done correctly, is boring.

So, here’s the golden rule: aim to invest at least 10% of your take-home pay. If you can’t hit that yet, it’s okay. Start small.

Let me show you why this matters. If you invest just $100 a month and achieve a modest 7% annual return (the historical market average after inflation), it grows to nearly a quarter of a million dollars in 40 years.

I can already hear the critics: “$250,000 in 40 years won’t be worth anything!” I’ve already factored in inflation. That’s the real return, not the nominal return. Please, don’t use nitpicking calculations as an excuse for inaction. If you’re waiting for the “perfect” time to start, the bad news is that it doesn’t exist. The good news is that today is a great second-best time.

Remember: time in the market beats timing the market. Your future self will thank you for starting now.

5. Are You in the Housing Red Zone?

You wouldn’t believe how many people are obsessed with the price of eggs or their partner’s energy drink habit, while I look at their numbers and see the real problem: they are spending far too much on housing.

If you are spending more than 28% of your gross income (your income before taxes) on housing, you are officially in the housing red zone. You have plenty of company.

Here’s how to calculate your number:

- Take your monthly rent or mortgage payment, plus utilities, repairs, and even the gas you spend driving to Home Depot for household stuff.

- Divide that total by your monthly gross salary.

- Multiply by 100.

That’s your percentage.

Historically, the goal was to stay below 28%. Today, especially in expensive cities, that’s incredibly difficult. I hate that this is the reality, but it is.

If you’re at 29% or 32%, it’s tight but manageable. But if you’re at 34% or higher, I can already tell you what your life feels like: you’re stressed about money. If you’re in a relationship, you’re fighting about money. And you’re fighting about the small things—”Why did you buy those M&Ms?”—but it’s not about the M&Ms. It’s because 35% of your income is being devoured by your roof.

Knowing this number is the first step to fixing it. If you’re over the limit, you can make a plan. Can you downsize? Get a roommate? Rent out a room? Move to a slightly cheaper area? The point is to stop ignoring the elephant in the room. If housing is consuming your income, getting ahead will feel like running a marathon with a backpack full of bricks. Your home should be a launchpad for your rich life, not a prison that makes you “house poor.”

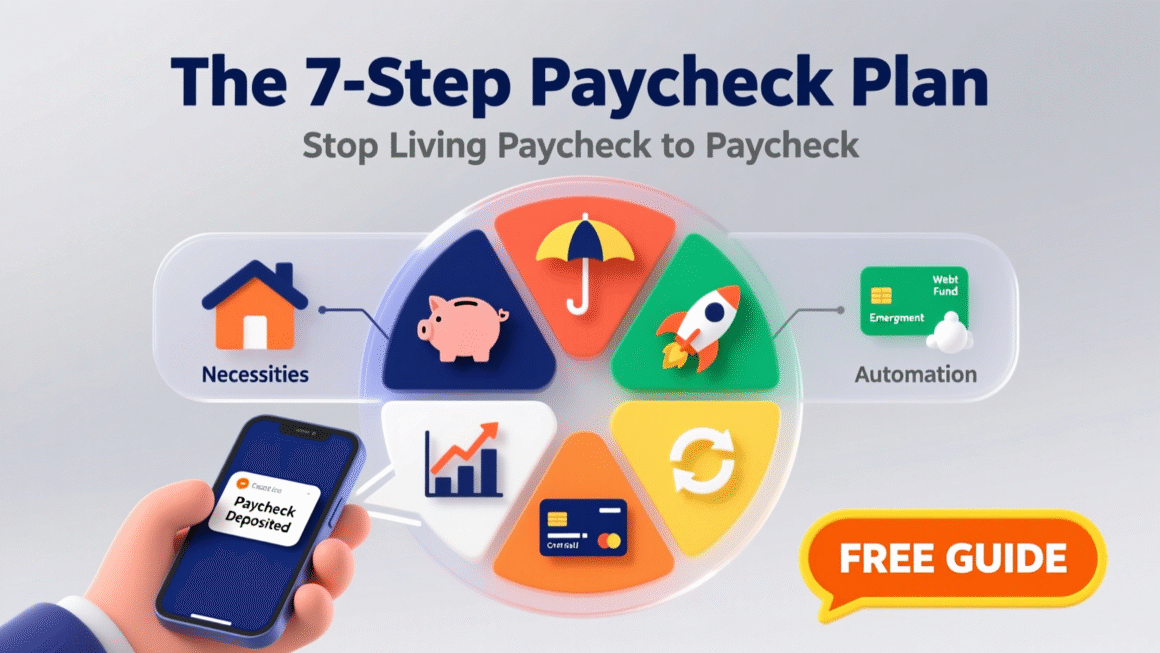

Step Two: Automate Your Finances Like the Top 5%

Now, take all the numbers you just calculated and write them down. Seeing them in black and white transforms them from vague anxieties into a clear starting point.

But knowledge alone doesn’t build wealth. You need a system. Imagine waking up and knowing your bills are paid, your savings are growing, and the money left in your account is yours to spend guilt-free. No stress. No daily check-ins. Your money automatically goes where it needs to go.

This is how the top 5% operate. Where most people mess up is by trying to save “whatever is left at the end of the month.” And there’s never anything left. The wealthy do the opposite: they pay themselves first.

Here’s how you can build this system:

- Retirement: Before your paycheck even hits your bank account, a portion is automatically sent to your 401(k).

- Savings & Investments: On a set date each month (e.g., the 5th), automatic transfers kick in.

- 5-10% goes to a high-yield savings account for your emergency fund and big future purchases.

- 5-10% goes straight into a Roth IRA or other investment account for long-term, tax-free growth.

- Bills: On another set date (e.g., the 7th), your system automatically pays all your bills—rent, utilities, insurance—so you never miss a payment or incur a late fee. Your credit card is also paid in full, so you never pay a cent in interest.

- Guilt-Free Spending: Whatever is left? That’s yours. Spend it on what you love.

You don’t need to track every dollar of that remaining money. You don’t need to feel guilty about oat milk. Your system ensures your financial foundations are rock-solid. The rest is for living. Once this automation is in place, you can focus on the ultimate goal: your crossover point.

Step Three: Calculate Your Crossover Point to Financial Freedom

Imagine waking up one day and realizing you never have to work again for money. Your life is funded by the money your money has already earned.

This is your crossover point. It’s the moment your investment income fully covers your living expenses.

You don’t need a lottery ticket or a million-dollar salary for this. You can build a system that makes it possible. Once you hit your crossover point, you have options. You can keep working, go part-time, take a sabbatical, or finally master the art of a three-hour brunch. That’s true freedom.

Let’s break down the math:

- Find Your Target Number: How much money do you need to cover your monthly expenses? This is your target monthly income from investments.

- Calculate Your Crossover Number: Plug that number into a retirement calculator to see the total investment portfolio you need to generate that income. (A common rule of thumb is the “4% rule,” where your target number is 25 times your annual expenses).

Now, you can play with the variables. This is where it gets exciting.

- The Default Path: Let’s say you make $80,000 a year, spend $6,000 a month, and invest 10% of your income. With a 7% return, you’d reach financial freedom in about 42 years.

- The Accelerated Path: Now, let’s make some intentional changes.

- Cut Expenses: Reduce your monthly spending to $3,000. Freedom arrives in under 13 years.

- Increase Income: Boost your income by 30% and invest all of it. Freedom in about 24 years.

- Do Both: Increase income by 30% and cut expenses by just 30%. You could reach your crossover point in approximately 14 years.

The takeaway is powerful: you don’t need to live on rice and beans or become a CEO. You need to be intentional about earning more, spending consciously, or ideally, a combination of both.

A Quick, Direct Word on How to Actually Invest

People often get stuck here, claiming it’s too complicated. They ask, “But how do I invest?”

It’s time to take responsibility. The information is everywhere. For the people who are ready to listen, here it is, stripped down to its essence.

Real investing isn’t stock-picking or listening to gurus on social media. It’s simple, boring, and incredibly effective.

- Index Funds: These are low-cost bundles of stocks that track the entire market (like the S&P 500). Historically, they’ve returned about 7% per year after inflation. They are an inexpensive, diversified way to invest that often outperforms expensive professional money managers.

- Target Date Funds: These make it even easier. You pick a fund with the year you plan to retire (e.g., Vanguard Target Retirement 2050 Fund). The fund automatically adjusts its asset allocation, becoming more conservative as you get closer to that date. They are available at major firms like Vanguard, Schwab, and Fidelity.

That’s it. That’s how you start.

The crossover point isn’t just about quitting your job. It’s about options, flexibility, and the power to design your life on your own terms. So, ask yourself: Do I want to reach my crossover point? If yes, what’s my path?

Step Four: Scale Up and Design Your Rich Life

Let’s zoom out. Once you know your crossover point, everything changes. You may not be financially free yet, but you are on the path. You’ve moved from “someday” to a real, tangible number. That alone puts you in the top 5%.

And whether you’re one year away or ten, now is the time to start thinking and living like someone who is already financially secure. Don’t wait until you hit your number to start enjoying your life. What a tragic waste that would be.

You haven’t come this far just to stare at your net worth like a score in a video game. For most, money is a source of limitation and stress. But for you, the 5%, money is a tool. It’s a lever. It’s a passport to the life you truly want.

Here are a few questions to help you design your rich life:

- What financial rules do I follow, and which do I throw out? You don’t have to do what everyone else does. Love the flexibility of renting? Do it. Don’t care about cars? Drive your old sedan with pride. Want to spend lavishly on travel or your children’s education? Your money, your values, your rules.

- Where am I spending too little? Now that your foundations are solid, what have you been needlessly holding back on? Your health? Convenience? Experiences? It’s time to invest in what makes you feel truly alive.

- How do I give back? Real wealth isn’t just about your bank balance; it’s about your impact. This could mean helping family, funding a passion project, or supporting a cause you believe in with meaningful action, not just a social media post.

- What is my next chapter? With money no longer the primary constraint, what do you actually want to do? Learn an instrument? Travel the world? Start a business? This is your chance to reconnect with old dreams and design a life with no limits, on your own terms.

Your rich life is yours to design, and the time to start is now.

This journey begins with a single, powerful milestone: reaching your first $100,000 in investments. Why $100K? Because that’s the point where the momentum truly shifts. Your money starts working harder than you do, and you finally, undeniably, feel ahead.